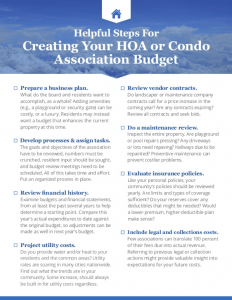

- Prepare a Business Plan

- What do the board and residents want to accomplish, as a whole? Adding Amenities (e.g. playground or security gate) can be costly, or a luxury. Residents may instead want a budget that enhances the current property at this time

- Develop processes & Assign Tasks

- The goal and objective of the association have to be reviewed, numbers must crunched, resident input should be sought and budget reviews meetings need to be scheduled. All of this takes time and effort. Put an organized process in place.

- Review Financial History

- Examine budgets and financial statements, from at least the past several years to help determine a starting point. Compare this year’s actual expenditure to date against the original budget, so adjustments can be made as well as in next year’s budget.

- Project Utility Costs

- Do you provide water and/or heater to your residents and the common areas? Utility rates are soaring in many cities nationwide. Find out what the trends are in your community. Some increases, should always be built in for utility costs regardless.

- Review Vendor Contracts

- Do Landscaper or maintenance company contracts call for a price increase in the coming year? Are any contracts expiring? Review all contracts and seeks bids.

- Do a Maintenance Review

- Inspect the entire property. Are the playground or the pool repairs pressing? Any driveways or lots need repairing? Hallways due to be repainted? Preventive maintenance can prevent costlier problems.

- Evaluate Insurance Policies

- Like your personal policies, your community’s policies should be reviewed yearly. Are limits and types of coverage sufficient? Do your reserves cover any deductibles that might be needed? Would a lower-premium, higher-deductible plan make sense?

- Include Legal and Collection Costs

- Few associations can translate 100 percent of their fees due into actual revenue. Referring to previous legal or collection actions might provide valuable insights into expectations for your future costs.

- Create a worksheet

- When you determine known expenses, start inserting the numbers into a spreadsheet and compare them with expected revenue. At least you’ll know how much above or below your projected operating costs you are.

- Prioritize Projects

- Something will need upkeep or change every year. Make sure needs – especially those that expose the association to liability (e.g. stairwell, repairs) – are budgeted for before wants (e.g. beautification projects).

- Expect the Unexpected

- Set aside funding for some “emergencies” that cannot be identified in advance. One year, mosquito abatement might be necessary; another year, vandalism might present a problem, or a storm might destroy landscaping. Being prepared is a good plan.

- Plan out Reserves

- Over a long enough period, projects such as replacing a building’s roofs are as inevitable as they are expensive. Experts suggest a good reserve study should tell you how to fund your expenses.

- Be Transparent

- It’s not possible to keep every resident happy, but keeping the budgeting process open and transparent at least gives residents a chance to have their opinions heard.

- Distribute the Budget

- Distribute the processed budget to the homeowners for their review and comment. Then, once the association board has approved the new budget, get it into the hands of all homeowners.

- Follow the Budget

- Except for emergencies that have not been budgeted for, follow your plan. The budgeting tool keeps the community operations on track.

Ask Us How We Can Help Plan Your Next HOA Budget

Insert link to the Proposal page

https://aphoamgmt.com/index.php/request-for-proposal

Based on below layout. We do not want to copy the colors, etc. but if you can match with the website, it would look good.